As a financial service, we work with many successful entrepreneurs. While working with each of them is very interesting, it is even more fascinating to see what they have in common. While skills and experience are definitely of high importance, it is certain character traits that make the difference. Here are the top three that […]

Accurately Forecasting Revenue with the Right KPIs

Accurate revenue forecasting is crucial for any business’s success. By focusing on the right Key Performance Indicators (KPIs) and collaborating closely with your marketing and sales teams, you can enhance your revenue prediction accuracy and achieve better business outcomes. Here are the essential KPIs to consider: Focusing on the Right KPIs New Deals Created Description: […]

Understanding the LTV to CAC ratio: A key to startup success

Understanding the Customer Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio is crucial for evaluating your company’s overall performance and guiding your growth strategy. This ratio reveals the return on investment (ROI) of your marketing and sales efforts, indicating how effectively your business is converting acquired customers into long-term, profitable relationships. What is the […]

Adoption of VC Tactics for SME Business Growth 💡📈

A prevalent misconception among business owners is that startup strategies and mechanics are too unconventional for established businesses to adopt. However, the financial principles from this field can definitely provide substantial benefits to existing businesses, especially SMEs with an intention to grow. Startup Finance Strategies A prevalent misconception among business owners is that startup strategies […]

Why I Founded Scalemetrics: My Journey from Venture Capital to Empowering Businesses

My journey in finance has led me from the distinct realm of venture capital to the dynamic world of startups and established corporations. As a VC, selecting potential winners was paramount, indicating the critical importance of financials in the success of both emerging and established businesses. The Challenges One thing that became increasingly clear: the […]

Facts vs. Fiction: How Finance Anchors Our Business Reality

A while ago, we were working with one of our clients, a B2C software company that was gearing up to scale a promising new product. Their strategy was ambitious: a product-led growth model based on the belief that the product’s significance and ease of use would naturally drive viral sales. The Reality Check Early analysis, […]

Navigating from B2C to B2B – A Client’s Journey to Success 🚀

We recently guided a client through a transformative journey, pivoting from a B2C to a B2B business model. B2C Challenges: A Mismatched Model Our client initially pursued a B2C approach with a promising product and a big market. However, our analysis revealed a stark mismatch: the product’s cost and customer acquisition expenses outweighed the consumers’ […]

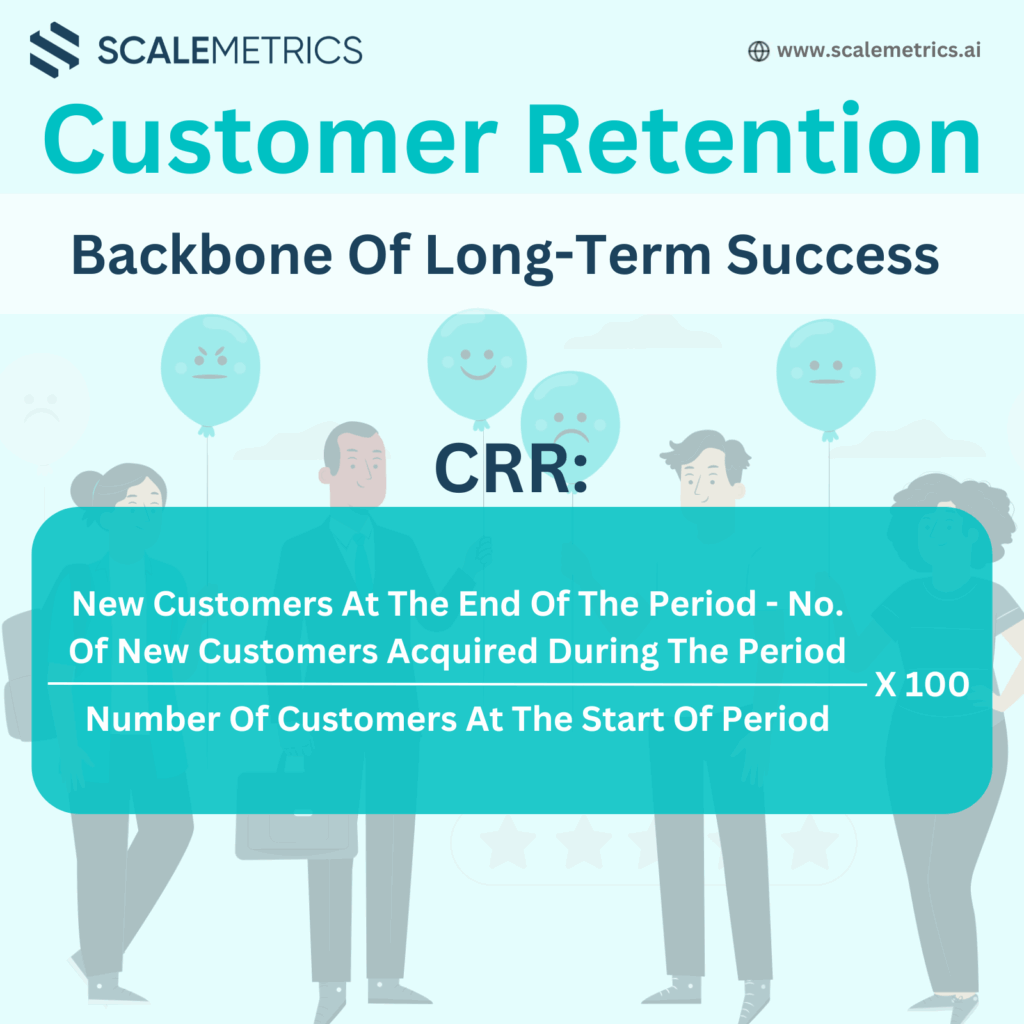

Customer Retention: The Backbone of Long-Term Business Success

In business strategy, a crucial yet often undervalued aspect is customer retention. But what exactly does this metric reveal and why is it vital? Understanding Customer Retention Customer retention reflects your company’s ability to create lasting value and maintain profitable relationships over time. It’s about understanding and expanding customer needs, leading to increased purchases over […]

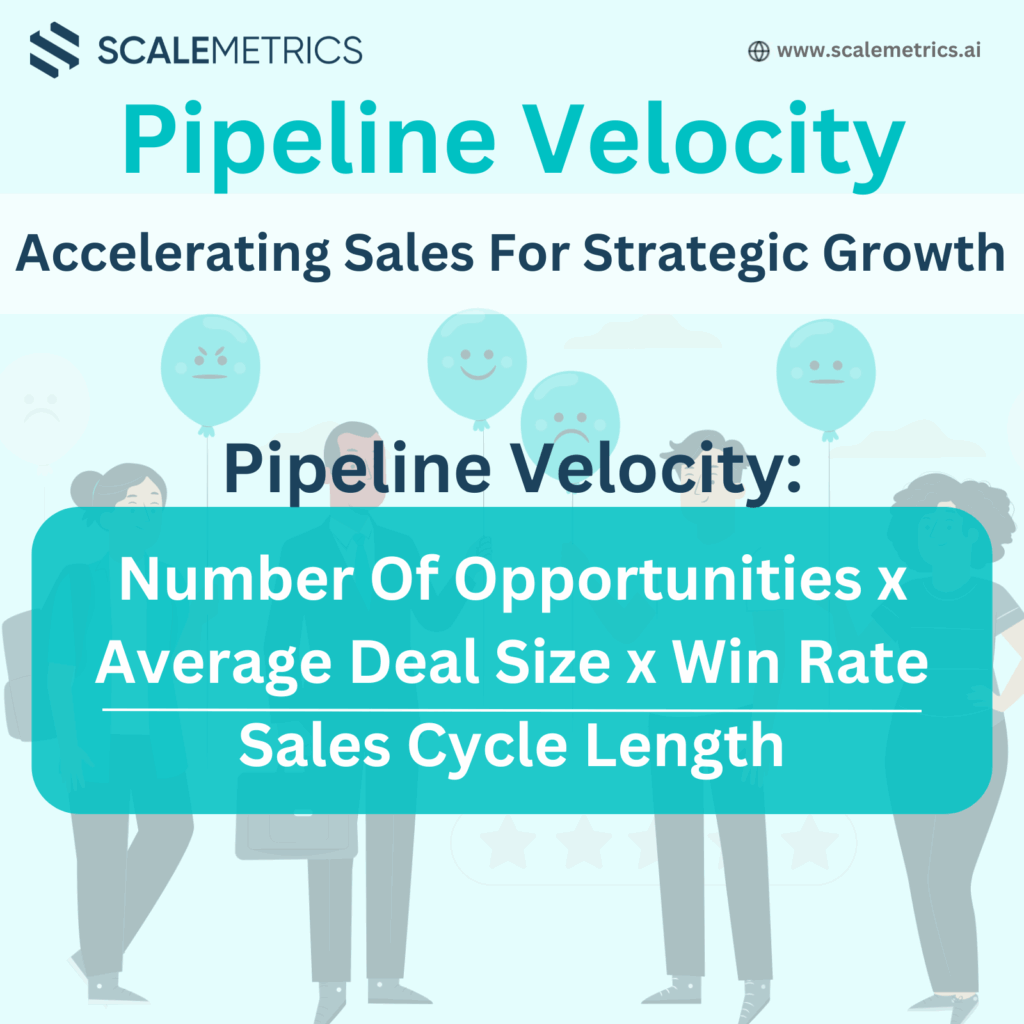

Pipeline Velocity: Accelerating Sales for Strategic Growth

In today’s fast-paced markets, understanding and optimizing your Pipeline Velocity is more critical than ever. But what exactly does this metric reveal and why is it vital? Understanding Pipeline Velocity Pipeline Velocity measures the speed at which leads move through your sales pipeline to become revenue-generating customers. It’s a powerful indicator of your sales process […]

Ending up in a Down Round Despite Your Best Efforts?

A down round, in which a company secures capital at a valuation lower than prior rounds, presents challenges yet also opens paths for stabilization and potential growth. Here’s a 6-step approach on how to lead them: 1. Preparation and Transparency Anticipate potential down rounds by realistically assessing your company’s valuation and being transparent about its […]